Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Do not save what is left after spending, but spend what is left after saving.

Warren Buffet

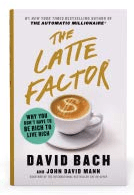

In the book The Latte Factor https://davidbach.com/the-latte-factor-class/, which I wrote about in a previous post, the author talks about paying yourself first. I really like his wording as it speaks to an important philosophy – that of taking care of your future before anything else. How does it work? It’s simple really, just ensure you are taking a portion of your pay each week and setting it aside. You pay your rent, your bills, and the tax man, but you need to pay yourself as well. And it’s important. Many of us, including myself, used to see the money left over after bills as free to spend. But that is a dangerous attitude, and it can get you into real trouble. One study from the U.S. concludes that 40% of Americans are only one paycheque from poverty. https://fortune.com/2019/01/29/americans-liquid-asset-poor-propserity-now-report/ A comparable Canadian study says 39% of Canadians are in the same predicament.

How much should you save? That is a difficult question to answer as I think it depends from individual to individual, but even if you’re only saving $10 a week, it’s still worth while. Those ten dollar bills will add up – and they may save your neck if the unexpected ever happens.

I’ll be setting up a TFSA next week. I’m excited about it as I’ll arrange to have a percentage of my pay automatically put into that account. That way I don’t even have to think about it, but I know I’m paying myself first.

By the way, after I set up my TFSA I’ll write about the particular TFSA I have chosen. It’s one where I can do my own investments, and if my hubby’s investment gains are any indicator, I’m sure to earn at least 30% every year. I’ll show you how I plan to do that.

Ok, so now I have to do the opposite of what I had been doing. I have to make eye contact with my money. In other words, I have to create a system where I can EASILY track my spending, my balances, my bills, etc. I’ve decided to use my bank’s app to do this. Since both my credit cards were not issued by my bank I needed to cancel them and apply for a bank card that would be fully linked to my bank app – for example, one where I could track weekly purchases and activity with a simple swipe on my phone.

Of course cancelling my cards meant moving any automatic debits onto another card, or onto my bank account (even better option). This was done with just a little effort.

It’s all about removing barriers. I knew that if it was going to be too hard, like if I had to physically go to the bank, or even log into another credit card’s online site, I’d put it off. This is where you need to get honest with yourself, and ask yourself what you can do to remove that barrier to your success.

It’s a good idea to look at your bank statement and your credit card statements every week. If these can all be linked to the same app, then all the better. I was also able to sign up for an additional notification app which would alert me to any purchases on my cards, etc.

The interesting thing is that since I’ve faced my money challenges head on, I’m no longer afraid to keep a close eye on things. Remember, I used to pretend it wasn’t an issue, or put it off, instead of staring my situation down and dealing with it. Now I’m motivated and excited to see how I’m doing every week. (By the way, this is a big deal for me…just sayin’)

Killing myself slowly, or maybe killing my future self, that’s what I was doing everyday when I used my debit card or credit card indiscriminately for meaningless purchases. Five bucks for a coffee, ten for a glass of wine at the rotary meeting, fifteen for that blouse at the thrift store, extras at the grocery store, twenty for that six pack….. Yes, it all added up but I never was the one to do the math. Why do I say I was killing my future self? I was killing the future I wanted by taking away opportunities, taking away the chance to do the things that really matter to me. The crazy thing is that now that I’ve turned things around, I can see that I still can do most of the things I desire. I still have coffee, it just comes with me in a travel mug. I still have lunch, I just pack it in the morning before I leave the house. I can still have wine, but I know it’s coming out of my weekly budget and once those bills are gone from my wallet, there is no more spending.

So what did I do to change things around? The first thing is I determined what my weekly budget could be. We discussed this earlier, but basically, I simply took my permanent bills (car payment, cell phone, insurance, etc.) and subtracted that from my net wages. I then determined how much I wanted to use each month to pay off my debt. (I’d moved my credit card debt into my line of credit to consolidate it and because it had a lower interest rate.) Next question was what percentage did I want to save? Once I’d set that amount the remainder was what I could spend each week. This amount would be taken out as cash each week.

So far this system is working well. It has taught me to respect my money as I can literally SEE it disappearing from my wallet. I’ve learned to plan ahead and strategize to ensure I have money for things later in the week. If I have money left over I place the remainder in an envelope to dig into during weeks when a little extra is required. The cool thing is I can spend this money completely guilt free. If it’s part of the budget it doesn’t matter if I decide to get a coffee at the coffee shop, or go out to lunch. This is great because guilt was something I was feeling when it came to money….it was buried deep down and rarely bubbled up…but the guilt was there, nonetheless. I freed myself from that guilt by taking charge and making choices. And it’s been easy, that’s the cool part too. It still astounds me that I can change the trajectory of my life with changes that are relatively painless. Maybe it’s the shift in mindset, but once I set my feet on this new path it has felt perfectly right.

Soon after our plan, my hubby came home with a book from the library for me. It’s a little book called The Latte Factor and it’s written by David Bach. If you want a book to illustrate the power of saving over small periodic spending habits, this book is for you. It’s a quick and enjoyable read as it follows the journey of one woman as she comes to the realization that she is doing it all wrong. She is stopping at the coffee shop on her way to work everyday, buying lunches and eating out for dinner. But at the same time she is working extremely hard and feels she will never get ahead. See the attached link to fine a cool calculator that adds it all up. https://financialmentor.com/calculator/latte-factor-calculator The reader learns as the protagonist learns and important points are reiterated throughout. In the end the protagonist changes her habits from emotion driven to purposeful and her life is completely changed. It also puts her in the driver’s seat, creating in her a mindset of intention and power. I love this book and it came to me at the best possible time.

The first thing I had to do was map out how much money came in verses what went out. So we sat down and wrote it all out …. pay in…bills out. I also had to look at those bills one by one. We’re they necessary? Could I live without that gym membership? (The answer to that one was no, but it was still a good question to ask) The money that was left over was what we needed to manage. Some to discretionary spending, some to saving. It was sort of exciting, as I could see that if I was purposeful in how I spent and saved I could actually do a lot more with my life. I actually had more than I thought. But the willy nilly spending of the past had obscured that fact. (All those coffees, etc.) We came up with a weekly budget that would allow me to pay off my debt quickly while also allowing me to save. We came up with three figures…..1) weekly discretionary budget ( I could spend this on whatever I wanted, but when it was gone it was gone) 2) monthly debt payment 3) monthly savings (This will go into a TFSA – tax free savings account – that will allow me to invest what I put into it) We had a plan and I had a plan of attack.

My credit cards were collecting dust on my desk. I didn’t want to look at them. You may know that feeling….just wanting to put it off for another time. The problem was that the longer I put it off, the higher the balance. I was aware of the crippling interest rates on most credit cards, and I was only paying the minimum, so I knew I wasn’t doing what I needed to do. That’s the weird thing. I wasn’t ignorant. I knew I needed to change how I managed my finances, but the problem had become so large I just kept putting it off. I’m not sure why I finally gathered the courage to take the step toward change, but I did. One day I just told myself that I needed help. A few days later the chance presented itself and I sat with a family member whom I trusted and respected. I started by saying that judgement (looks of shock, disdain, etc.) could not be part of the conversation. I wanted to change so it was all about moving forward and creating a plan. I’m happy to say we did that and we created a plan that I’ve been able to stick with…easily. I’m noticing my mindset is changing and it excites me. I do things I never would have done before – like notice a bill that needs to be paid and do it right away, or I strategically plan my spending for the week so I have enough for what I want to do. Like the title states, it’s a journey, but I know I’m on the right track. In subsequent posts I’ll outline the plan we created and I’ll also mention some great books that were fun to read and just what I needed at the time.

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.